This article is a part of our series focused on helping newcomers to the world of Web3 understand the value of decentralized finance. Read on to explore the remittance landscape, current challenges, and how blockchain can help create cheaper, faster, and more inclusive remittance solutions.

By 2030, the global remittances market size is expected to reach ±$107 Billion, growing from $48.9 Billion in 2021. Personal remittances (e.g., those made by migrant workers) are estimated to make up roughly two-thirds of the overall market during this time.

Traditional cross-border payment methods lack the ability to adequately service this uptake in demand. They are often slow, expensive, and inaccessible to a large portion of the global population.

Cryptocurrencies, and their underlying technology, are an important enabler of cheaper, faster, and inclusive remittance solutions. And this has been shown in the past few years where the industry witnessed a significant growth in crypto-based cross-border remittances.

In this article, we will explore the drawbacks of current remittance services, the advancements in crypto remittances, and the potential of blockchain-based solutions to transform the global remittance landscape.

To deep dive into remittances, download our in-depth report on the future of remittances and how blockchain can make it cheaper, faster, and more inclusive.

Download The Report on The Rise of Blockchain-Based Remittances in LATAMThe Current Remittance Landscape

Cross-border payments play a vital role in global commerce and individual financial management. However, the existing system has multiple drawbacks yet to be addressed:

High Transaction Costs

According to the World Bank, the average cost of sending $200 across borders is around $13 (6.2%). These fees can be even higher when dealing with certain countries or remote regions, presenting a significant financial burden for those sending money home to their family.

Time Delays

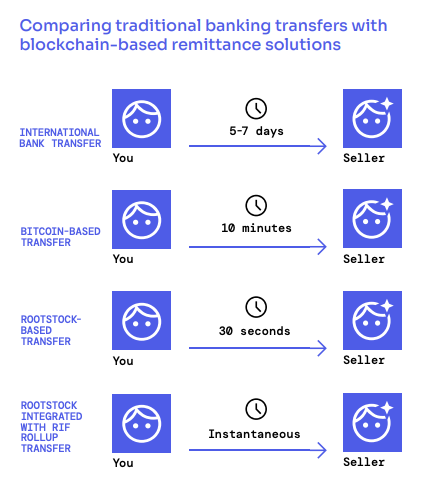

Traditional cross-border transactions can take several days to process. This delay is due to the multiple correspondent banks the money has to travel through before it reaches the final recipient. Each stop along the way generates additional time and fees for the transaction.

Limited Access

Despite the progress of digital technology, over 1.4 billion adults worldwide don’t have access to banking services, especially in emerging economies. For example, in Latin America, it is estimated that over 65% of the population is underbanked or unbanked.

For these individuals, sending or receiving money across borders is a considerable challenge — requiring them to rely on less secure methods.

The Potential Of Crypto Remittances

Cryptocurrency has the potential to offer an effective solution to the challenges of traditional remittances. It is a decentralized, secure, and low-cost way to send money anywhere in the world.

Decentralized

Cryptocurrency transactions occur directly between sender and receiver, without the need for a central authority or intermediary, such as a bank.

Moreover, the decentralized infrastructure of blockchains enables true borderlessness. Unlike traditional currencies, which are tied to specific countries and subject to their respective regulations and exchange rates, cryptocurrencies can be sent and received by anyone with access to the internet.

Speed

Cryptocurrencies can also significantly increase the speed of cross-border transactions. Instead of waiting for multiple banking institutions to validate and process transactions, cryptocurrency transactions can be completed within minutes with 24/7 availability.

Lower Costs

Thanks to crypto remittances bypassing the need for intermediaries, cryptocurrency transactions usually involve far lower fees when compared to traditional services. They can also provide more predictable fees (depending on the network), which can be especially helpful for those sending money regularly.

Financial Inclusion

Cryptocurrencies are accessible to anyone with an internet connection, opening up financial services to previously unreachable populations. By enabling the unbanked and underbanked to send and receive funds securely and quickly, crypto remittances can foster financial inclusion on an unprecedented scale.

Challenges Of Crypto Remittances

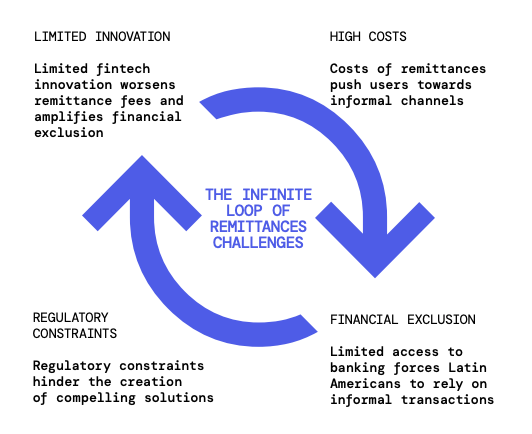

Despite the advantages, there are hurdles to overcome before the widespread adoption of crypto remittances can be established:

Regulatory Concerns

Cryptocurrencies face a highly fragmented regulatory landscape, with rules varying widely from one jurisdiction to another. This is especially relevant for cross-border transactions, where different countries have different laws and regulations. This lack of clear policies and regulatory sandboxes can make it difficult to determine what is allowed and can deter some from using these services.

Usability and Adoption

Although awareness of cryptocurrencies has grown, many people find them intimidating or challenging to use. Navigating the technicalities of blockchain solutions can be complex for those accustomed to traditional banking systems.

Ensuring more user-friendly interfaces for crypto apps and simplifying user onboarding could play a significant role in the broader adoption of crypto remittances.

The Future of Crypto Remittances

The rise of cryptocurrencies has set the stage for a new era in remittances, promising to bring about a much-needed change in an industry that’s remained largely unchanged for decades. While there are still hurdles to overcome, crypto is primed to deliver a more inclusive, efficient, and cost-effective remittance landscape.

To learn more about the potential of crypto remittances, check out the RIF Remittance Report. It offers an in-depth look into the current drawbacks of the remittance industry, the role cryptocurrencies have to play, and what we can expect as we head into the future.

Download The Report on The Rise of Blockchain-Based Remittances in LATAMRecommended Reading

- Learn about the competitive advantages of blockchain-based solutions to conduct payments in our article about the top 5 reasons more businesses are adopting crypto payments.

- Explore one of the most prominent use cases of crypto in our in-depth article about DeFi lending and why it’s soaring in Latin America.

- Understand the importance of crypto-based buy-now-pay-later solutions in our detailed article about BNPL solutions for a more inclusive financial ecosystem.