This article is a part of IOV Labs’ series focused on helping newcomers to the world of Web3 understand the value of decentralized finance. Read on to explore the top 4 reasons triggering businesses into exploring crypto for remittances.

The world is becoming increasingly interconnected. With a global digital economy on the rise, the ability to transfer money across borders quickly, securely, and affordably has never been more important.

However, traditional banking and money transfer services are falling short when it comes to global remittances. They’re expensive, slow, and often inaccessible to the people who need them most.

Enter cryptocurrency. With its promise of faster transactions, lower fees, and greater accessibility, they have the potential to completely revolutionize the remittance industry.

As a result, more and more businesses are beginning to explore crypto as a genuine remittance option. Some are already integrating crypto remittance solutions directly into their products.

Download our in-depth report for a deep dive into the future of remittances and how blockchain can make it cheaper, faster, and more inclusive.

Download The Report on The Rise of Blockchain-Based Remittances in LATAMIn this article, we’ll explore the main causes behind this shift in the remittance industry and highlight how businesses in LATAM are leading the way.

1. Migration Patterns

Income gaps, conflict, violence, and climate change issues have driven people to seek opportunities beyond their origin countries. And migrants frequently need to send money back to their origin country to help support their remaining relatives. This, in turn, has created a substantial demand for reliable and affordable remittance services.

Traditional money transfer services and banks have fallen short of providing an effective solution for migrants. They are often slow, with transfers taking days to complete. And their fees can be high, particularly for those sending smaller amounts of money.

On top of this, they are often inaccessible to many who need them most. According to World Bank data, more than 1.4 billion adults remain unbanked globally. This makes receiving remittances through traditional services a significant challenge.

Fintech firms, specifically cryptocurrency providers, have emerged as a powerful force in addressing this challenge. They can provide faster, cheaper, and more inclusive solutions and offer a level of transparency and security that is lacking in many traditional systems.

Alternative providers are beginning to transform the remittance landscape. The shift towards digital remittances, powered by crypto, is making it easier than ever for migrants to support their families back home.

2. Financial Inclusion Initiatives

The International Monetary Fund (IMF) found that remittances encourage unbanked people to begin using financial services. Essentially becoming ‘banked’ enables them to utilize a large range of services the institution provides.

Recognizing the close link between remittances and financial inclusion, policymakers have begun initiatives to bolster remittance flows.

These include the United Nations’ goal to lower transaction costs to 3% by 2030 and the G20’s roadmap to enhance the transparency, access, and speed of cross-border transactions.

Businesses and Fintechs are realizing that by incorporating remittances, they can offer a solution to a market currently excluded from the traditional financial system. One of the most efficient and accessible ways to implement such services can be crypto.

3. Regulatory Reforms

Policymakers are establishing global regulations for remittances to develop formal remittance channels and improve their efficiency. These clear guidelines are making it easier for businesses to build remittance services without running into unforeseen legal barriers.

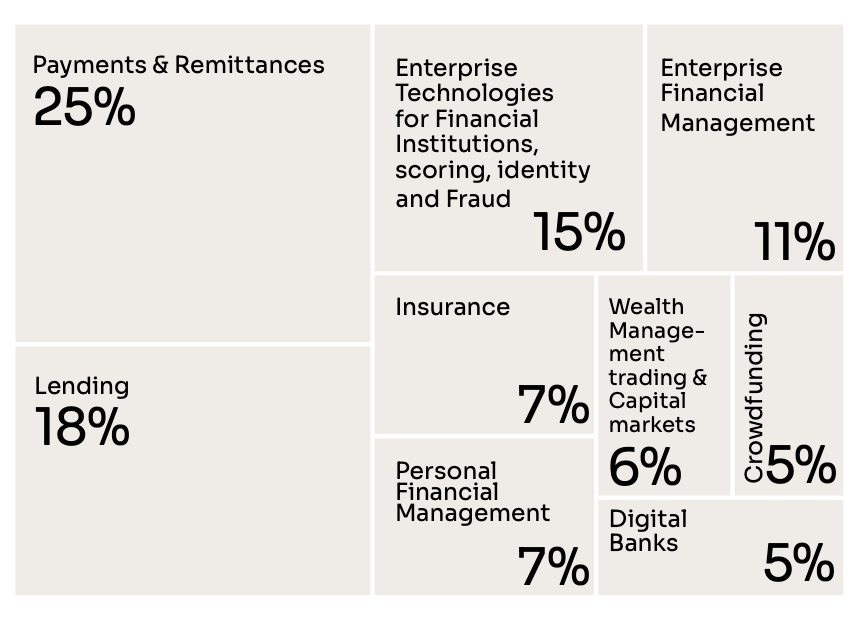

Businesses in LATAM especially have embraced this clarity. As of 2022, remittance solution providers make up 25% of Fintechs operating within LATAM.

4. Advances in Technology

The continuous rise in smartphone ownership and internet connectivity in emerging economies has also helped to further the cause of digital remittances. More people than ever can now access digital financial applications.

However, in LATAM, informal remittances are estimated to be 50% larger than those formally recorded. People are still using methods involving family, friends, and travelers to help get money from one geographic location to the next.

Why? Because it’s cheaper and often faster than the digital methods available. In Latin America, the average cost of a remittance transaction is around 6.2%. This means that to send $300, users will end up paying about $20 in transaction fees.

Leveraging crypto and blockchain-based solutions, such as RIF Rollup, can lower transaction fees to almost 0.05%. And the transaction will occur within less than a minute — helping to reduce the need for informal remittances.

Businesses Using Crypto For Remittances

Several businesses have already successfully integrated crypto remittances into their operations. In 2021 alone, 621 fintech startups in Latin America offered payment and remittance solutions.

Some of the companies leading the way in the crypto remittance industry include:

Mercado Libre: Latin America’s largest e-commerce platform is leading the charge with its robust payments ecosystem with crypto integrated into its services. The financial arm of Mercado Libre — Mercado Pago — allows users to make cross-border payments with cryptocurrency. Mercado Pago is a fully digital platform where you can open an account in minutes and begin managing your finances however you please.

Nequi: A digital bank in Colombia, Nequi has embraced the potential of blockchain technology for remittances since 2019. They do not charge anything to their users when receiving remittances and do not require them to fill out any paperwork. This streamlines the process and significantly reduces costs compared to traditional services.

PicPay: A Brazil-based mobile payment platform, PicPay allows users to hold, send, and receive Bitcoin through their application. This offers a faster alternative to traditional remittance channels and provides an added layer of security and privacy.

These innovative businesses are paving the way for others to integrate crypto remittances into their services.

Our In-depth Remittance Report

Our recent remittance report offers a comprehensive guide for businesses interested in the rapidly evolving field of remittances. The report explores the key advantages of crypto remittances, showcases successful case studies, and looks ahead to upcoming trends and opportunities in the space.

Embracing crypto remittances could mark a major step forward for many businesses, reducing costs and fostering financial inclusion. Download the RIF remittance report today to learn how your business can benefit from this innovative shift in global remittances.

Download The Report on The Rise of Blockchain-Based Remittances in LATAMRecommended Reading

- Learn about the competitive advantages of blockchain-based solutions to conduct payments in our article about the top 5 reasons more businesses are adopting crypto payments.

- Explore one of the most prominent use cases of crypto in our in-depth article about DeFi lending and why it’s soaring in Latin America.

- Understand the importance of crypto-based buy-now-pay-later solutions in our detailed article about BNPL solutions for a more inclusive financial ecosystem.