We are pleased to announce the launch of the Rif on Chain DeFi platform (ROC), the first RIF DeFi ecosystem built and deployed by Money on Chain (MOC) on top of the RSK blockchain network.

MOC released one of the first bitcoin-collateralized DeFi solutions, which allows users to interact with a trustless and decentralized system. MOC’s bitcoin-collateralized Defi platform has various key features which: (i) allow bitcoin holders to earn a passive income from staking their bitcoins, (ii) provide stablecoins collateralized by bitcoins to any user willing to mitigate volatility risk, and/or (iii) offer a bitcoin leverage-asset for users willing to increase their long position exposure. The MOC platform has recently proven to be one of the most robust decentralized-financial platforms in the crypto environment.

By extending its technology to the RIF ecosystem, MOC is providing the foundation elements for the creation of a Defi ecosystem backed by RIF tokens and deployed on the RSK blockchain network. This represents a significant milestone for our community, given that we expect it to be one of the driving forces accelerating the growth of the RIF token economy. As we will explore further below, Rif on Chain (ROC) offers a fast and secure platform for transacting RIF-backed products, as well as an opportunity for RIF token holders to generate a passive income through different means.

Briefing

Before getting into details about the specifics of each asset, it’s worth understanding the mechanics behind the Money on Chain (MOC) DeFi platform by viewing this short video:

At launch, the RIF on Chain Defi platform will principally consist of three main assets that interact with each other, and which have been developed to serve different purposes depending on the needs of the user. These include: (i) the RIF Dollar (RDOC), an asset-backed stablecoin pegged to the US Dollar and fully collateralized with RIF tokens; (ii) the RIFpro (RIFP) token, the cornerstone of the ecosystem enabling the minting of RDOC and RIFX through a token staking model; and (iii) RIFX, a leveraged trading asset with exposure to movements in the RIF token price.

Rif on Chain (ROC) DeFi platform

The first step to accessing and interacting with the ROC platform is to ensure that the user has RIF tokens in a compatible hardware wallet, such as Nifty or Metamask. RIF tokens can be purchased in exchanges such as Coinbene, Bitfinex, Bithumb, Liquid and MXC among others.

Once the user acquires RIF tokens, he will be able to interact with either RDOC stablecoins, RIFpro or RIFX. Let’s explore each of these platform assets in further detail.

Overview on Stablecoins

Before diving into the RDOC design and function, it’s worth recognising the purpose and structure of existing stablecoins. Stablecoins are designed to keep a steady store of value allowing crypto traders and investors to mitigate risk and escape market volatility when a sudden drop hits the whole market or to lock-in gains as “the bears eat everyone’s portfolio piece by piece”. Stablecoins are necessary for anyone who wants to benefit from advantages of using crypto currencies and blockchain technology, but without being exposed to price volatility. Some areas in which volatility represents a problem are:

- Remittances

- Commerce & Payments

- Salaries & Rents

- Lending & Prediction markets (long-term issuances)

- Store of value for hedging (miners covering recurring costs)

We can divide stablecoins into 3 groups:

- Fiat-collateralized

- Crypto-collateralized

- Non-collateralized.

- Fiat-collateral stablecoins are backed by currencies such as US Dollars/Euros and their major flag-bearers are Tether USDT, USD Coin, Gemini, USDC, TUSD.

- Crypto-collateralized are commonly “decentralized” stablecoins backed by crypto assets such as MakerDao, Steem or Alchemist.

- Non-collateralized have a more complex structure and are based in seigniorages shares, decentralized banks and algo stabilization mechanisms. Some examples include Terra, Ampleforth and Element Zero.

RDOC categorization

In light of the above stablecoin classifications, the RIF Dollar stablecoin (RDOC) would constitute a crypto-collateralized stablecoin on the basis that it uses the RIF token as collateral.

What makes this stablecoin different from other crypto-collateralized stablecoins, is the mechanism through which RDOC is issued. Without going into the specifics of Money on Chain mathematics (which are explained in detail in the MOC Whitepaper), the RDOC stablecoins will be minted whenever there is a certain amount of RIFpro (RIFP) staked in the platform. This doesn´t mean that users must personally stake RIFP themselved in order to get RDOC, this denotes that RIFP must be staked in the platform (by any users) before any RDOC are minted and made available to be acquired in the platform. Thus, whenever the minimum threshold of RIFP that needs to be staked is achieved, the ROC platform will automatically trigger the minting of RDOC so that any user can acquire them, store them in a hardware wallet, transfer them to another user or utilize them for buying products that are made available for purchase in the RIF Marketplace. The main point to understand here is that the RIFP token is the key component for the generation of RDOC.

The question now arises as to how do the RDOC stablecoins benefits the RIFP tokens as precursors of the system?

- RIFP tokens are staked allowing the issuance of RDOC stablecoins.

- RDOC stablecoins transfer their volatility to the RIFP tokens plus a percentage of the fees paid for their acquisition by stablecoin users. At this primary point, RIFP will have some leverage as a consequence of receiving the stablecoin volatility and will start to accrue fees paid by RDOC purchasers.

As an example using random math relationships between RIFP and RDOC, we show below the back and forth of these pairs from having 16 RIF tokens in the platform.

E.g. 16 RIF Tokens in the system at a RIF market price of $1,00 will issue 14 RIFP and subsequently $2 RDOC, resulting in $16 dollars in the system absorbing $2 RDOC volatility. Those $2 dollars volatility will be distributed among the RIFP, consequently the leverage factor will be of 1.1428X per RIFP staked [$16 / ($16 – $2)] => 14,28%.

Please note that numbers and values used are by way of example and not based on real ROC values.

However, the essence of RIFP is to allow RIF token holders to generate a passive income, principally from fees generated by users interacting with the platform, rather than as a result of RIFP being a leveraged product by design. Therefore, while it could be considered an advantage to retain some leverage on a long-staked position (if the underlying asset price rallies), it also represents a risk, particularly if there is a downturn in the market. The design of RIFP is therefore intended to offset additional volatility through (a) the fees that RIFP tokens receive, but also (b) by transferring a major percentage of that leverage to the RIFX, known as the “leveraged asset” in the ROC platform.

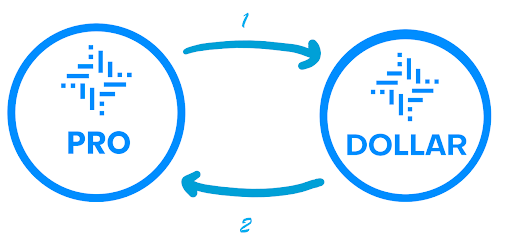

It follows from the foregoing, that RIFP tokens will “fictionally sell” most of their leverage inherited from the RDOC stablecoins to the RIFX, thereby closing the entire economic circuit of the ROC DeFi platform as shown in figure below:

- RIFP tokens are staked allowing the issuance of RDOC stablecoins.

- RDOC stablecoins transfer their volatility to the RIFP tokens plus a percentage of the fees paid for their acquisition by stablecoin users.

- RIFP tokens will transfer most of their volatility received from the stablecoins to RIFX leverage asset.

- RIFX users will pay an interest rate for trading the RIFX leverage asset and the ROC system will distribute that interest among the RIFP tokens.

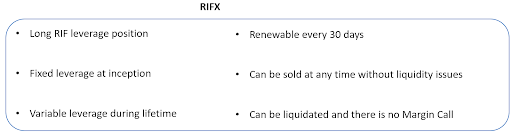

The RIFX is a leveraged product that is set to renew every 30 days and provides traders and speculators with a tool to leverage up their gains (or losses) whenever there is a movement in the market price of the RIF token. In summary, RIFX is a leveraged asset that renews on a monthly basis. The questions that arise are:

What is the leverage factor? Is it fixed during the lifespan of the contract?

RIFX has a fixed leverage multiplier of 2X at the beginning of each contract that might vary during its 30-day lifespan depending on different variables, such as the amount of RDOC stablecoins available in the platform and the RIF price movements in the market. It’s important to be clear about this leverage variability; whenever someone acquires RIFX (except when it is acquired at the very beginning of the contract), it´s very likely that the leverage received will be different than 2X so it´s fundamental and highly recommended to check the leverage factor on the RIFX Wallet section or on the Metrics section in the DeFi platform before entering a trade. It is also crucial to notice the distinction between RIFX and more conventional leveraged assets (e.g. ETFs), where the leverage ratio is perpetually fixed in most of the cases.

Following our previous example with random numbers illustrating the relationship between RIFP and RDOC, we will add RIFX into the equation and close the economic sequence of the ROC platform:

E.g. 16 RIF Tokens in the system at a RIF market price of $1,00 will issue 14 RIFP, $2 RDOC and subsequently 1 RIFX. $2 RDOC volatility will now be distributed among 14 RIFP and 1 RIFX. So what was used to be 14,28% (2 RDOC for 14 RIFP = 2/14 = 1/7 = 14,28%) in the previous case, will now be 1 RDOC volatility for 14 RIFP and 1 RDOC volatility for 1RIFX. This reduces the volatility of the RIFP by half 1,071X and allows the system to start with a leverage multiplier of 2X for the RIFX.

Please note that numbers and values used are by way of example and not based on real ROC values.

To summarise, RIFP tokens will serve as the cornerstone product of the platform and will benefit from fees paid by RDOC purchasers + the interest rate paid by RIFX traders on their leveraged positions. RIFP tokens will also be exposed to a small part of the volatility (translated into “leverage”) absorbed from the stablecoins, which will benefit them in the long run, provided that the RIF token price increases in value.

It’s important to highlight that the full redemption of the stablecoin position (selling the RDOC stablecoins for RIF tokens or transferring them) is entirely available at the expiration of the RIFX contract, which occurs every 30 days, and partial/full redemption is available during the lifespan of the contract depending on the amount of outstanding RIFX. The rationale behind this is that if the price of the token rallies in the market, the RDOC stablecoins are the ones who are going to “pay” to the RIFX the leveraged gains. To maintain the soundness and functionality of the ecosystem, it is therefore crucial to have a minimum amount of RDOC stablecoins in issue within the platform for the duration of the RIFX contract. However, whereas the RDOC stablecoins might have redemption limitations (as explained above), RIFX can be sold at any time, thereby providing additional flexibility for traders willing to transact this product.

Please take a moment to review the following example:

As shown above, at the beginning of the contract (N0) the system has 2 RDOC and 1 RIFX with a RIF market price of $1,00. At N1 the price of the token has jumped in the market by 25% to $1,25 generating a +50% gain in the RIFX position due to its 2X leverage. Given that the RDOC stablecoins are Stable by definition, they won´t get benefit from the rally and they will transfer those gains to the RIFX, “paying” its leverage. The inexistence of RDOC for backing up the leverage of the RIFX due to a total allowance in their redemption at any given moment would have jeopardized the entire system.

Please note that numbers and values used are by way of example and not based on real ROC values.

To conclude the first part of the post, it is vital to know several operational aspects that surround the interaction with the RIF on Chain (ROC) DeFi platform.

Once the RIF tokens are acquired, the token holder must send the acquired RIF to a MetaMask or Nifty wallet. When using MetaMask, RIF holders must be sure to have a proper configuration of the RSK network for transferring RIF tokens into the app. For further information about configuring the Metamask wallet, please refer to the following link:

https://dev.rootstock.io/develop/apps/wallets/metamask/

As a last step, the user must click in the following link and allow MetaMask/Nifty to interact with Rif on Chain platform by approving the automate connection of the wallets with the platform.

Rif on Chain (ROC) token summary

RIF DOLLAR (RDOC)

The RDOC is a stablecoin pegged 1:1 to the US Dollar and guaranteed by a smart contract. Users will be able to redeem their full RDOC position at contract expiration or partially during the lifespan of the contract depending on the availability of redeemable RDOC stablecoins.

Another important feature about RDOC is that it is fully collateralized by RIF tokens, and users can acquire them directly in the platform without needing to provide any collateral or CDP like other DeFi platforms.

The RDOC token can be transferred among users and can be used for purchasing services and products, specifically dApps blockchain products that will be released on the Rif Marketplace. Another characteristic of the token is that it can be stored in any compatible hardware wallet.

RIFpro (RIFP)

RIFP is a token that mirrors the RIF volatility plus a small amount of leverage that it receives from the RDOC stablecoins. The RIFP token will benefit from a percentage of the transaction fees charged by the ROC platform to the users of RDOC and to the traders of RIFX. This is why the RIFP is a suitable token for RIF holders who wants to earn a passive income with a minimum leverage on its RIF token position.

RIFX

RIFX is a RIF leverage decentralized long position. Based on an automated smart contract that renews every 30 days, the product has a leverage factor of 2X at the very beginning of its lifespan and a variable leverage afterwards based upon certain variables such as the price of RIF token and the amount of RDOC stablecoins in the ROC platform. Users must be aware of the risks associated with trading a leverage asset and should understand that their positions might be liquidated. The ROC platform, in this current version, does not have a Margin Call notification. The RIFX product can be sold at any time without needing to wait until expiration like in the RDOC stablecoins.

Having described this fantastic ROC DeFi ecosystem created and run by Money on Chain, we encourage all RIF holders and RIF users to embrace it and explore the advantages and benefits that it has to offer.