For a sense of how global the economy is, it’s worth taking a look at remittances. Data from the World Bank reveals foreign workers sent $647 billion to their loved ones back home in 2022 — a figure that’s expected to rise to $656 billion this year.

Remittances are an essential source of income in emerging economies, with experts describing them as a “financial lifeline.” But here’s the problem: not all of this cash reaches its intended destination.

Underbanked communities often have to rely on intermediaries to receive funds — but these services come at a premium. The latest figures from the World Bank suggest average remittance fees stand at 6.25%. This means that, in 2022 alone, hard-working migrants would have lost $40.4 billion of their income — cash that could have made a life-changing difference at home.

Remittance fees have come down in recent years, but nowhere near enough. And now, current market leaders are considering alternative remittance methods, such as crypto and DeFi to make cross-border payments cheaper, faster, and more inclusive.

Are you interested in building a remittance solution? Talk to our experts to learn moreMigration Patterns to Spain

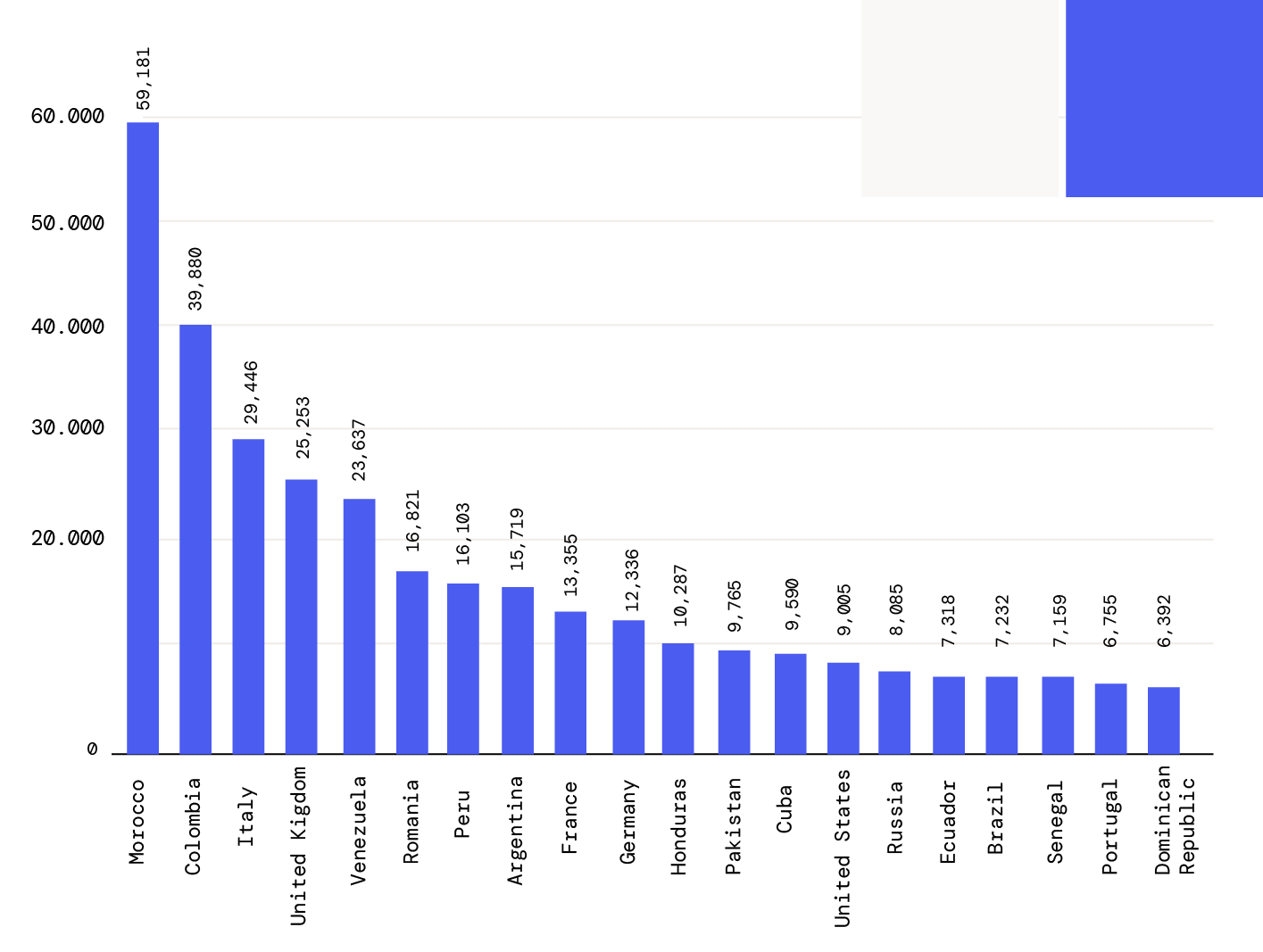

For a case study that illustrates why this matters, let’s turn our attention to Spain. Migrants account for 11.3% of the population — and of those, 41% are from predominantly Spanish-speaking countries in Latin America.

Figure 1. Origin of immigrants to Spain from across the globe.

Those crossing the Atlantic and moving thousands of miles away from their loved ones often have compelling reasons to do so. An opportunity for better income is a major one.

The average annual wage in Spain stood at €29,113 in 2022 — that’s about $25,000 at current exchange rates. By contrast, figures from the OECD indicate yearly salaries are just $22,248 in Colombia, and $16,685 in Mexico.

Download The Report on The Rise of Blockchain-Based Remittances in LATAMRemittance Trends & Challenges in the Spain-LATAM Corridor

Given there are 50 countries in Europe, it’s pretty remarkable that Spain makes up 9% of total remittance outflows from the continent. Of this figure, 24% heads toward Latin America and the Caribbean.

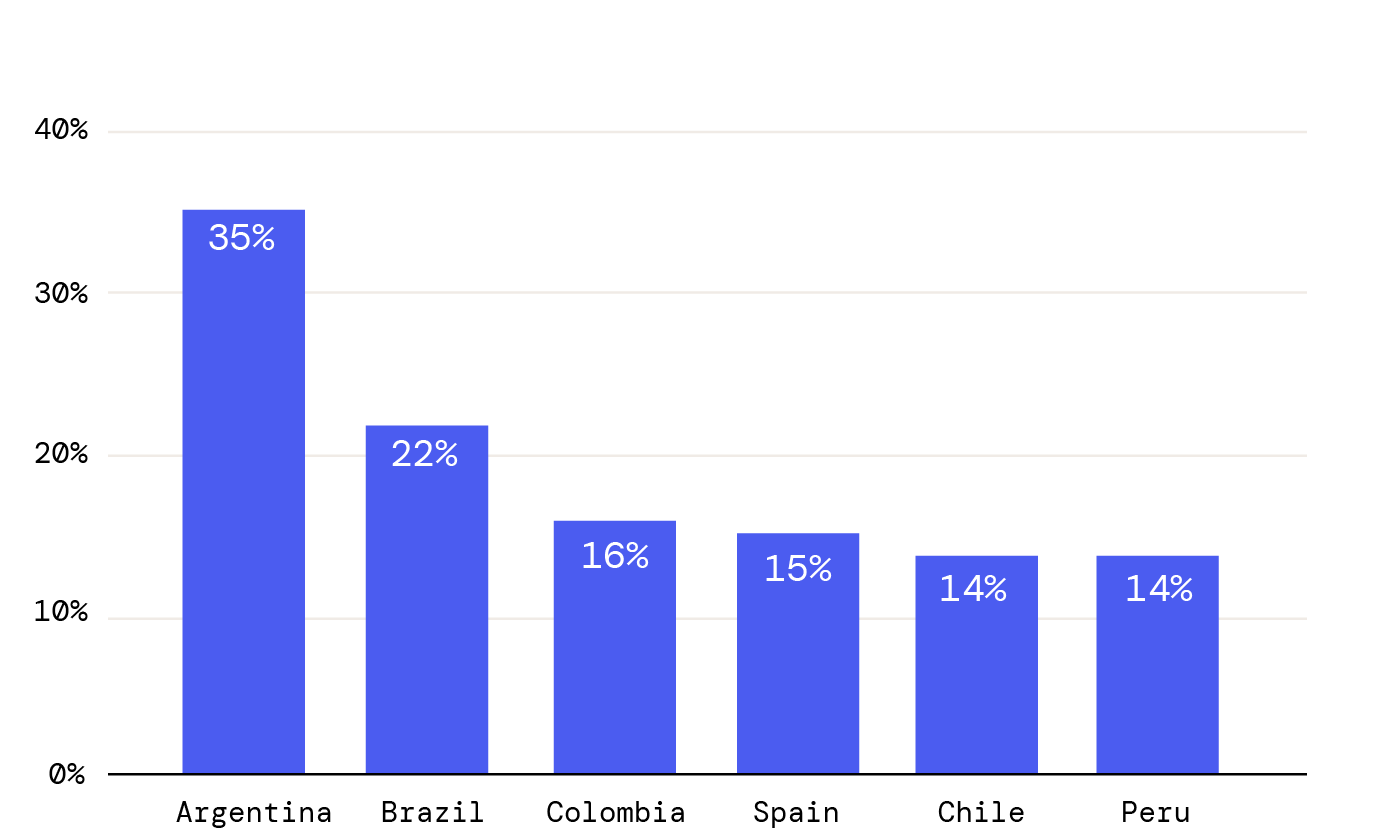

Figure 2. Remittance outflow from Spain to different regions.

And while typical remittance fees from Spanish providers are lower than the global average, standing at about 5%, this is still a hefty figure considering that up to 25% of GDP in El Salvador, Honduras and Jamaica is derived from these overseas payments.

Figure 3. Percentage of the GDP made of remittances in Latin America.

The Growth of Crypto Remittances Between Spain and Latin America

High fees and long waiting times for remittances help explain why Spain is a dominant player in crypto adoption — with the ownership of digital assets also high in Latin American nations. EU regulations, as well as an open-minded approach in Madrid, have delivered greater clarity on the rules of the road for consumers and companies alike.

Figure 4. Rising crypto ownership among Spainish and Latin American populations.

Download the full infographic for more details about the Spain-LATAM remittance corridor.

Key Players Facilitating Remittances & Fees for Using Each

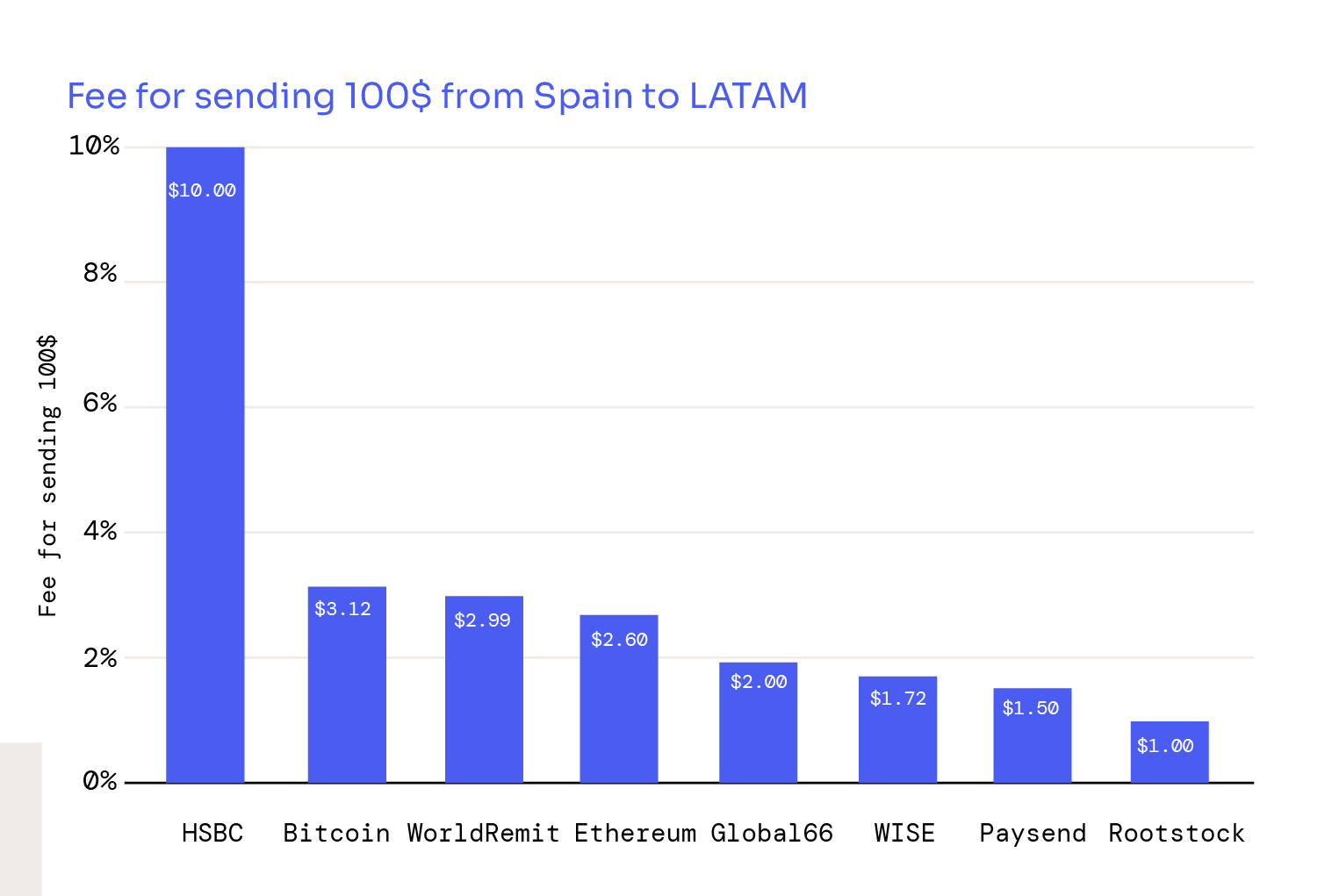

The method used for sending funds from Spain to Latin America can have a huge impact on the cost — and comparing the fees of legacy players with crypto upstarts is sobering.

The latest figures suggest HSBC will charge $10 for a $100 transfer — that’s 10%. This falls to $3.12 for Bitcoin, $2.60 for Ethereum, and $1 for Rootstock, which sits atop of the Bitcoin blockchain. To put these figures into context, Rootstock’s remittance fees are 90% less than one of the world’s best-known banks.

Let’s imagine a migrant worker is sending $1,500 of savings back home to Peru. Compared with HSBC, they would save $135 in fees by using infrastructure built on Rootstock. This is a game-changer. In Peru, that’s more than the average worker earns in a week.

What’s more, Rootstock RIF Rollups can slash remittance fees even further — to lows of $0.01 per $100 transferred.

Figure 5. Fee for sending 100$ from Spain to LATAM using different platforms.

Why People Are Choosing Crypto for Remittances

The cost saving is a compelling argument in itself — but there’s more to this than meets the eye.

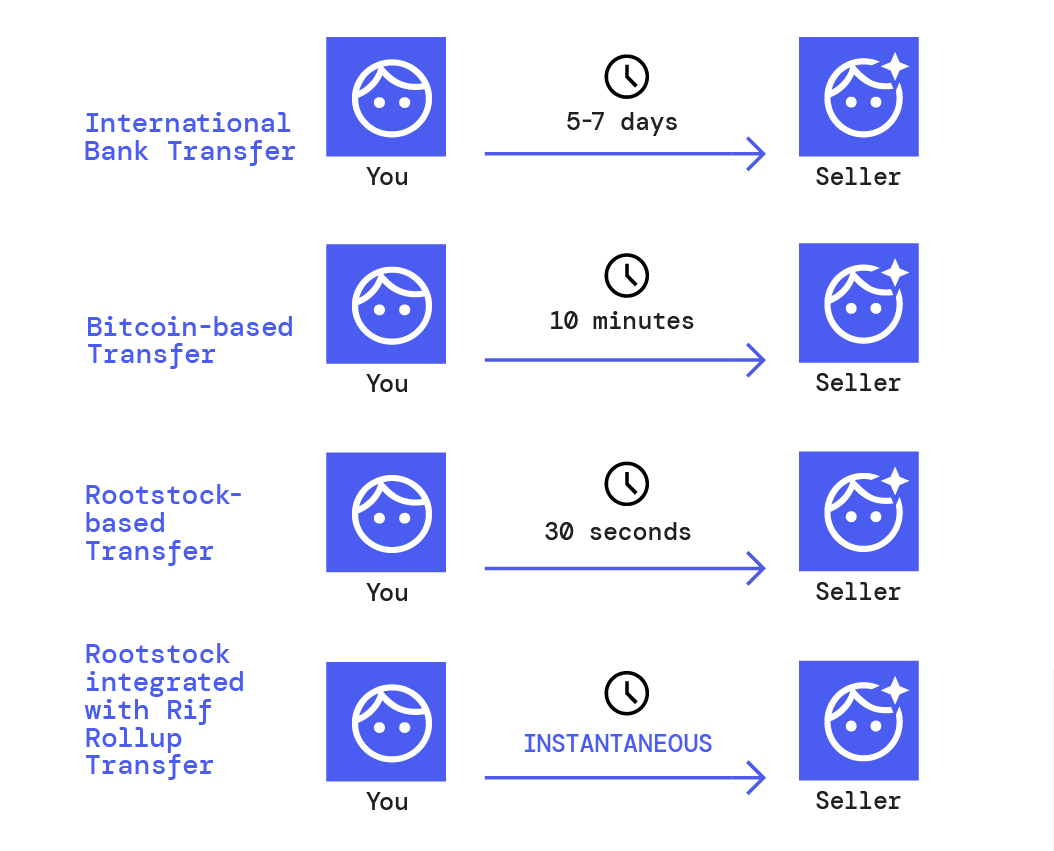

Not only do migrant workers end up paying top dollar when making cross-border payments through banks, but they’re also the slowest method available… taking five to seven days on average. Slow and expensive is not a good combination — and to add insult to injury, 65% of the population in Latin America lacks access to traditional financial services.

Bitcoin improves this dramatically by reducing settlement to 10 minutes, the time it takes for a new block to be added to the blockchain. Rootstock-based transfers slash this to a mere 30 seconds — and through RIF Rollups, payments are truly instantaneous.

What would you pick when sending $100: a $10 fee and a seven-day wait, or a $0.01 fee and immediate arrival? It’s a no-brainer.

Figure 6. Comparing traditional banking transfers with blockchain-based remittance solutions

How RIF Can Transform Remittances

Everyday DeFi is crucial for delivering a fairer future for everyone — making remittances more inclusive as well as cheaper and faster.

Right now, RIF technology is delivering intuitive crypto wallets that are beautifully designed, with a user-friendly experience that puts consumers first. Crucially, affordability and simplicity are not at the expense of security.

Download the full infographic for more details about the Spain-LATAM remittance corridor.